New Update 12/6/2022

What is the CPRX crypto token for?

CPRX crypto is the trading symbol for the Crypto Perx token. This crypto token was created by an organization called the Crypto Banking Alliance. The stated goal of the org and, by extension, the token is to support the adoption of cryptocurrencies in banking and finance.

3 billion total CPRX were minted at creation to be used for that purpose. At the moment of creation, in theory, the total marketcap value of those tokens was $0 due to there being no use-case or utility for them yet.

The token had it’s first (and currently only) real-world use case start in November 2021 with a cryptocurrency exchange based in the United States called Abra. The alliance made them a grant of 1 billion tokens. Abra used the tokens as awards for its customers as an incentive to hold assets on the platform, trade, or as a reward for referring new customers to sign up.

The use of CPRX crypto by Abra was similar to how Celsius, Nexo, and Voyager used their CEL, NEX, and VGX tokens respectively to boost returns for holders. As far as I know, Abra was the first and only US-based exchange to offer this kind of incentive. It is likely that the creation of the Alliance was driven by Abra’s desire to compete with international providers on a more equal footing.

Abra abandoned the use of CPRX for rewards amid the market shocks of 3AC, FTC, and Luna/Terra collapses. The token still exists but has no current use. Holders of CPRX on Abra continue to accrue interest rewards. There have been mentions of plans to do something with the tokens in the future but no firm plans have been revealed.

It remains to be seen what use-cases and grants will be made by the CBA with the remaining 2 billion CPRX they hold. Any current or future value that the token has on the market is exposed to a potential big swing depending on the details of how an eventual tripling of market float is handled.

How much is CPRX?

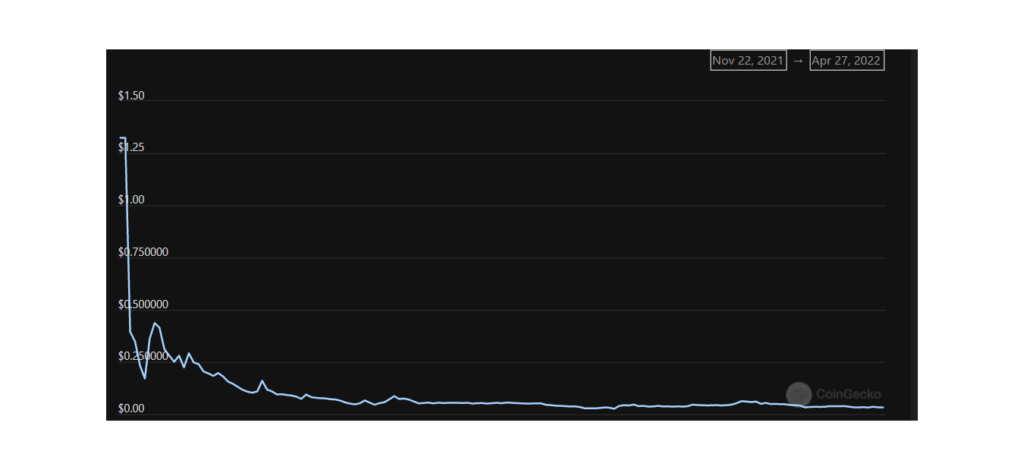

Crypto Perx price on the open market has consistently gone lower since the coin was first introduced for use by Abra. The chart below shows its price trajectory from launch through late April 2022. Since then the token has essentially flat-lined at about 1 cent with very little trading volume.

Early in the chart below, United States customers were unable to buy or sell. There is bump in late November 2021 when US customers were enabled. From that point forward, the preceding general downward trend has continued largely unabated.

Restricted Selling by Abra

The chart above would probably have been worse than it looks already. Why? In the early months after launch, sales of CPRX in the Abra app were limited to 500 CPRX per hour. In early March 2022 sales of CPRX within the Abra app were completely halted.

Throttling and halting sales while allowing buying to occur is a market-manipulative action designed to prop up the price. It is impossible to know what the actual market price of the token would have been without those restrictions in place but it is reasonable to assume “lower”.

During those times sales of CPRX could be made on Bittrex and Uniswap. However, the distribution strategy Abra followed paired with the cost of transfer fees make it unlikely many holders would go through that trouble. The dampening of sale pressure was likely therefore significant.

What is the Future of CPRX?

There has been only one use for CPRX so far. It was used by Abra as a rewards and incentive program but ended. Customers of Abra that held CPRX tokens in their account received increased interest payments, trading fee rebates, and discounts on their loan percentage rate.

Abra’s future is probably CPRX’s future until new use-cases and partners emerge. (If that does in fact ever occur. It is not impossible that additional grants could be made by the CBA to Abra instead of diversifying.) It is also entirely possible that the CBA would simply abandon the project.

However, if there is a restart by Abra of a rewards program, here’s a bit of analysis based on what they offered previously.

The top tier with Abra requires holding 50,000 tokens. It is reported that Abra was awarded 1 billion coins from the Alliance. (Note: Abra holdings are not transparent or substantiated by the firm. Proceed with caution.) Quick math shows that only 20,000 customers will be able to achieve and hold the top tier without further grants. Abra recently reported 2.5 million total accounts so 20,000 is not a big number as a percentage even if we accept that some portion of the total accounts are fraudulent to game the referral system.

Maybe scarcity for top tier rewards is enough to drive demand and price up over time. So far however it hasn’t been. In fact, given the low-cost of acquiring that top tier level, it appears there is exceptionally low interest in Abra’s offering on a global level.

Before ending their program, Abra was paying competitive stablecoin rewards in kind and offered a 5% bonus in CPRX at it’s top tier. At 3.5 cents for CPRX that meant for $1750 an investor with only $35,000 in a stablecoin would get their acquisition cost back and then 100% return on their $1750 each year thereafter. That incentive was not sufficient to drive demand.

The math above would have held if the value of CPRX remained stable AND if the investor could liquidate regularly without excessive fees. The sliding value combined with an inability to liquidate with low fees made the math above fail in the real world.

Can Abra Be Trusted?

I don’t know and it makes me feel bad to write that. I would like to trust their ability to grow as a business and succeed going forward. Abra certainly deserves acknowledgement for surviving the market implosions of 2022. Some larger brands can’t say the same.

There are some good signs. The CEO (Bill Barhydt) is out in front engaging the community, has a demonstrable history in this space, and communicates in a clear engaging way on his weekly AMA-style YouTube channel discussions.

Additionally, Abra has existed as a company longer than many other exchanges so has a track record of not going out of business, maintaining security without significant public breaches, etc. Also, it is a US-based exchange so there is significant legal recourse and protection compared to exchanges in some other jurisdictions.

On the other hand, given Abra’s time in market, experience in the space, and the strong public persona of Bill, why is Abra a virtual “also ran” in terms of market share? US-based exchanges Coinbase, Kraken, Gemini, etc. all dwarf Abra’s business. Why has Abra lagged so far behind? Part of the answer might be that Abra doesn’t aspire to be an exchange so much as a crypto bank. However, I’m not clear on how the way that Abra makes money is different from a typical exchange. Seems like the same business model with aspirational branding as far as I can tell.

Additionally, the way that Abra communicated around CPRX sales restrictions and their holdings appears to be either incompetent or intentionally deceptive. I wish I could go with “incompetent”. However, the ample opportunity Abra had to clarify their actions and their CPRX holdings/distributions without doing so means… well, maybe they don’t know they could do those things? I guess it’s up to you to interpret for yourself. My view is it indicates an inability to have hard conversations and work transparently when things are challenging. So, if the going gets tough Abra appears to get silent.

The above looks like warning signs of how the business is managed and how it values transparency with its customers. It would be hard to custody any serious assets there without feeling a need to spend extra attention monitoring them than is required with a Coinbase or Fidelity relationship.

My Plan for CPRX

I’m passive at this point. I’m sitting on multiples of the “To The Moon” tier essentially by accident due to the 5% earn fees accruing and not wanting to go through the hassle and fees of transferring out to sell.

On balance I’m trying to stay cautiously optimistic about the future of Abra and CPRX. I am rooting for them to succeed. Let’s hope that surviving another crypto winter will help Abra level-up it’s communications and transparency. It would also be great to see a viable use-case for a token like CPRX to emerge from the rubble.

This is not investing advice!

Seems like it should be obvious but this is not investing advice. I’m simply a guy on the internet sharing a point of view and my own experience. Do your own research, etc.

Leave a Reply